There is a lot of market selling going on right now and you might not even know it! That’s right, because every doom and gloom report that hits Wall Street is turned to a positive in hopes that you don’t see the bottom line data. Wall Street has been cramming this crap data down your pie-hole to convince you that everything is just peachy keen and your investments are safe—you know the headlines: Real Estate sales up, Jobs claims down, Inflation is low, Consumer spending is up, cats and dogs are seeing eye to eye on everything, farts smell like roses and no, that shirt does not make you look fat! We are bombarded by all this yellow journalism in hopes that you will believe there is nothing wrong with the U.S. Economy. But we are Broken. Actually, under the $3000 suit, your broker is most likely freaking out and shorting anything in the U.S. market, while telling you that your nest egg is just fine. Look for fingernail bites next time you shake his/her hands.

Let’s take a look at the S&P500—Historically the S&P500 is the bible for investments. Most mutual funds will perform at or near the S&P500, and because of it, many investment portfolios are based on it. The S&P is about to test some nasty historical data this is NOT good for your Green Backs!

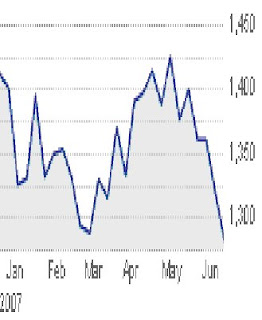

S&P 500 6 month Chart from CNBC.com

Start Dec 2007 and end June 2008

We are in the Midst of a triple-bottom in the major U.S. markets—a point where a major sell-off is imminent unless something magical happens, and the FED may have already used all of the get out of jail free cards. The 1st bottom happened back in January when the credit crisis really showed it’s head. The futures markets on the open looked so grim that people were expecting a 5-7% drop, but Benny B and the fab Fed 5 came in and dropped the benchmanrk lending rate by 75 basis points. Wowzers! They saved the day! People started to buy stocks again, the markets slowly recovered and banks continued to lend, but at a tepid pace. But we were not done. The 2nd bottom came in March with a sell-off of Bear Sterns. The not-so-grizzly Bear had a liquidity crisis and was going to go on a permanent hibernation, but the Fed came in wearing shiny suits and again saved the day with a quasi-bankruptcy-buy-out that allowed the Bear to be bought out by JP Morgan. The Fed was saving the banks from doom and the Bear issue had been caged! This again brought more buyers of stock who believed that this HAD to be the market bottom. But it was not the bottom, as you can see in the chart above. After reaching a high point in May, the markets have been in a turbulent sell-off. We are seeing the triple-bottom as the trend is breaking through the lows of the 2nd bottom. Uh Oh! This is not good!

People like to make money—and they hate losing money, especially when they have lost money twice. When someone buys stock at the 1st bottom, they see the stock go up and they are happy! They buy things—houses, cars, kool-aid, gas, coloring books, boxed wine and smokes—They are happy people because they made money! Then the stock falls back to the point where they bought it and they are sad. But it’s OK—the stock goes back up! But then it comes back down again! Now the stock buyers are not happy at all—their cash has been a wash or a loss at this point. When we start to hit the 3rd bottom most people will just say Phuket Thailand and Sell Sell Sell, regardless of the price or the loss. This sell off will continue as all the bottom of the market is not in the seeable future.

But wait! The Feds came in the last two times with magical rate cuts and quasi-bankruptcy love… can’t they save the markets this time? This is a tricky one. Because the Fed, Benny B and Crew, have been loving on Wall Street during this whole no-inflation, no-recession, no-problems, no-economic nuclear winter roller-coaster, they are stuck inbetween a rock and a hard place. You can’t have inflation during a recession, and you can’t say we are in a recession—it’s a psychology thing you know—you can’t tell the U.S. consumer who can’t afford food, gas or electric, and who is losing his/her job that we are in a recession… that might just break him. The recession is the huge 10,000 pound pink elephant in the room that no one is talking about. If the Fed raises rates it will strain the already broken banks by stripping a percentage of their profits (ha ha… I said profits when referring to the bank stocks). But if they don’t raise rates, inflation will come and gobble up the already mentioned consumer. So, for now the Fed has to sit on the sidelines and see what happens. This is bad for the third bottom. Investors will continue to sell sell sell until something is done—until someone screams, “The is a huge elephant in the room people! A HUGE pink elephant!” And when that happens we will see another steep sell off as the roller-coaster barrels down faster and deeper than the previous two dips. This sell off will be rough, but with the cat out of the bag, we will find the sought after market bottom.

But with no recession and no inflation and no problems being talked about, who knows how long this could take?

No comments:

Post a Comment